Should Retailers Extend Black Friday Sales in 2020?

The importance of Black Friday as a single day of sales has diminished as shopping is increasingly moving online. This is especially true in 2020 as e-commerce is expected to grow by over 30% due to the coronavirus pandemic’s impact on physical retail.

To keep pace with the competition and capture a share of consumers’ shrinking budgets, retailers need to innovate in their approach to sales to make sure they do not miss any opportunities. One way to do this is by spreading special offers over a longer period (i.e. extending Black Friday offers).

In addition to helping you sell more and win sales over the competition, extending Black Friday offers has the advantage of easing pressures on digital infrastructure and supply chain management.

Black Friday becomes Black November

In a recent Accenture study, 64% of consumers said they are less likely to shop on Black Friday and 59% said they are less likely to shop on Cyber Monday, up from 55% and 47%, respectively, in 2019.

Large retail chains, including Home Depot, Walmart, Target and Best Buy, will remain closed on Thanksgiving Day and are extending their sales throughout November to avoid overcrowding in physical stores during the pandemic. The disruption to physical shopping is expected to move millions of dollars of shopping online, with consumers avoiding going to stores.

US consumer goods have given back almost none of the online penetration gained during coronavirus lockdowns, according to analytics firm 1010 data, ensuring that purchases will remain online over the holiday season. Online share for consumer goods purchases increased to 48% during lockdowns from 38% previously and has held at 46% since the lockdowns.

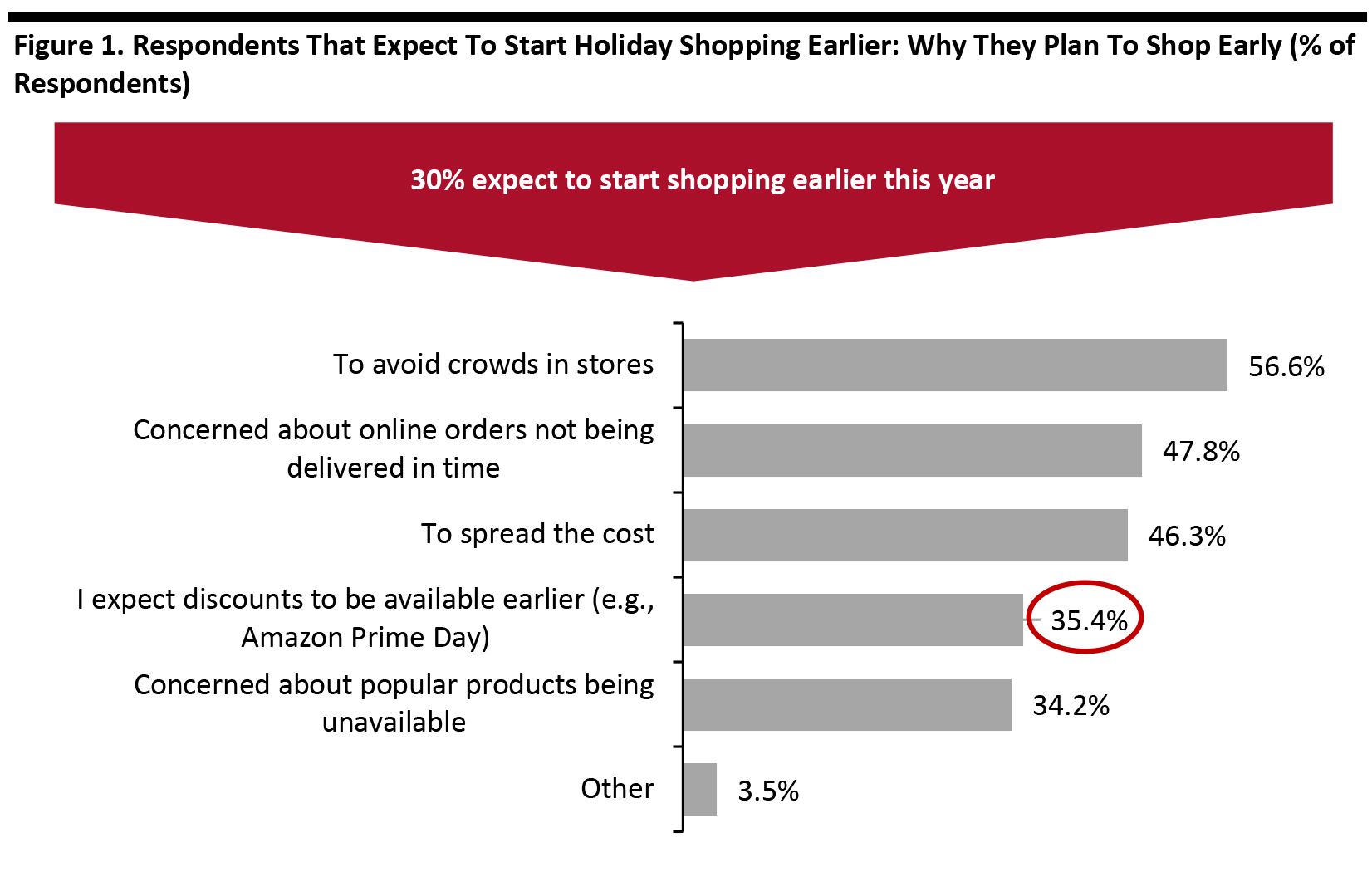

The shift online and the disruption to supply chains during lockdowns poses challenges for retailers facing a surge in online orders if they do not have a robust e-commerce platform in place. Around 30% of respondents to both Accenture’s study and a Coresight Research poll said they plan to start their holiday shopping earlier this year to make sure they get what they want.

Consumers are aware of the pressures on shipping capacity, with 47.8% of the early shoppers in Coresight’s study concerned about online orders being delivered in time and 34.2% concerned about products being unavailable.

Prepare your e-commerce platform

As the above data trends show, the changes to online shopping this sale season demand that retailers make sure their e-commerce platforms are capable of handling the rise in traffic and that they have transparency into their supply chains and inventory.

Retailers will be competing for share of a smaller pie this year. With unemployment having risen sharply during the pandemic, shoppers are likely to spend less on their holiday purchases this year. Although 44% of consumers in Accenture’s survey said they plan to spend the same amount as last year, 41% expect to spend less—nearly three times the number from last year—and only 15% said they plan to spend more.

A focus on efficient order fulfillment and a seamless user experience —along with attractive discounts—are the key to gaining share online during the holiday season.

Tech advocate and writer @ fabric.